Jeremy Nicholls, VP, Fraud & AML Compliance, WFCU Credit Union

With the rise in popularity of digital assets such as Bitcoin, cryptocurrency investment scams have become a growing concern for many Canadians. These scams often promise large returns with little or no risk, preying on people’s desire for quick profits.

At WFCU Credit Union, we work hard to keep you safe from financial harm. To help protect members from cryptocurrency investment scams, we’ve developed the following list to provide you with key watchouts for a variety of scams.

Guaranteed Profits: Scammers often lure investors by promising guaranteed, high returns with little or no risk. Legitimate investments, especially in volatile markets like cryptocurrency, never guarantee profits.

Too-Good-To-Be-True Offers: If an investment seems too good to be true, it probably is. Watch for promises of doubling or tripling money in a short time frame.

Urgency or Limited-Time Offers: Scammers often push potential investors to act quickly, claiming there’s a limited-time offer or an exclusive opportunity. High-pressure tactics are a major red flag.

No Time for Research: If you are told there’s no time to verify the details, it’s a sign the investment could be fraudulent.

Vague or Complicated Explanations: If the investment is explained in overly complicated terms or the details are unclear, that’s a red flag. Scammers often use technical jargon or vague descriptions to confuse potential investors.

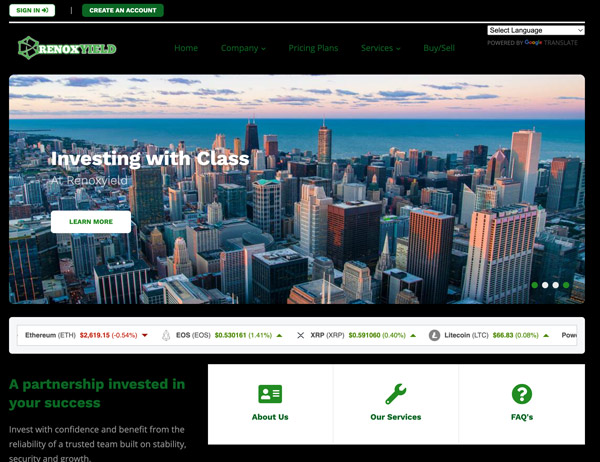

Unclear Company Background: If the company or platform is difficult to research, lacks a clear business model, or has no verifiable history, it’s worth being cautious.

Unlicensed or Unregistered Advisors: If the person promoting the investment is not a registered financial advisor or the platform is unregulated, it’s a major red flag. Legitimate investments should come from credible, licensed sources.

Offshore or Unregulated Exchanges: Be wary of investments made through platforms not registered or regulated by financial authorities. Check https://www.wikifx.com/en/ for up-to-date information.

Deepfake Videos or Celebrity Endorsements: Scammers may use deepfake technology or fake endorsements from celebrities like Elon Musk or Justin Trudeau to make their schemes appear legitimate and to build false credibility.

Overly Positive Reviews: If an investment platform or advisor has only glowing reviews or testimonials without any criticism, it could be a sign that the feedback is fake or manipulated.

Withdrawal Delays or Conditions: A significant red flag is when investors can deposit money easily but encounter issues when withdrawing funds. Scammers often impose unexpected fees, taxes, or other obstacles to prevent withdrawals.

Requests for More Money: If you are asked to pay additional fees or taxes to release your investment, it’s almost always a scam.

Cold Calls or Social Media Ads: Scammers frequently reach out through unsolicited messages, phone calls, or online ads offering investment opportunities. Reputable sources typically don’t use these aggressive tactics.

Promoting a “Secret” or “Exclusive” Opportunity: Watch out for offers that claim to be part of a secret, exclusive, or insider deal. Scammers often use these phrases to pressure potential investors into acting quickly.

New or Unknown Cryptocurrencies: Scammers may push investments in little-known or newly created cryptocurrencies, often promising huge gains. If the cryptocurrency is not widely recognized or researched, it’s a red flag.

Pump and Dump Schemes: Scammers artificially inflate the value of a cryptocurrency to attract investors and then quickly sell off their holdings, causing the value to crash and leaving investors with worthless assets.

Personal and Financial Details: Be cautious if you are asked to provide sensitive personal information, such as Social Security numbers, passwords, or other financial details. Scammers may use this information for identity theft.

Unsecured Websites: If the investment platform doesn’t use secure (HTTPS) connections or requires unnecessary personal details, it’s likely unsafe.

Jeremy Nicholls, VP, Fraud & AML Compliance, WFCU Credit Union

For additional tips, visit our Member Protection page on our website. If you suspect fraudulent activity on your ECU account(s), please contact our Member Contact Centre immediately at 1-888-767-9353 or security@myECU.ca.